How does Multi-Manager perform?

So, is Multi-Manager investing proving itself as a valid investment approach for KiwiSaver and non-KiwiSaver investors? Absolutely!

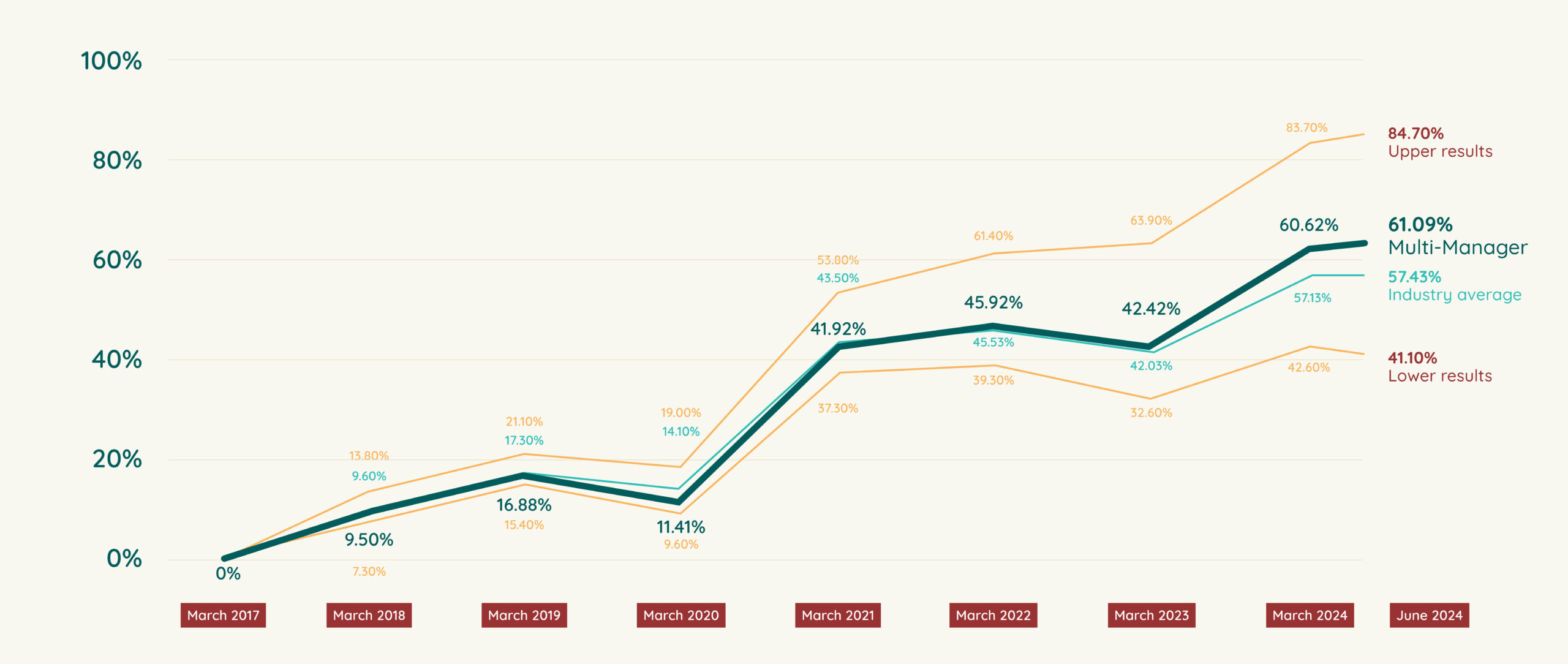

Multi-Manager investing doesn't try and "beat the markets", or to be "the top performer". History has shown that's a fool's game as, mathematically in order to attempt that, you must also risk failing and being a poor performer. Multi-Manager investing includes multiple, non-correlated investment styles, philosophies and methods, simultaneously in the one account or portfolio. This increases your expertise exponentially, reduces your risk and makes a successful outcome more reliable. It is designed to eliminate the risk of under-performance, which every investor that uses a single fund manager or investment style, is taking. By including multiple fund managers, each working simultaneously with, but independently of, the others, an industry average performance for the investor's profile, is the most likely result. The following chart of rolling 5-year returns for the Growth managers our clients use in every account, shows that is exactly what has been achieved.

The graph below illustrates the variation in results across "Growth" KiwiSaver managers in New Zealand over the last 6 years. We have shown the industry average and Fusion Multi-Manager results for you to compare. The numbers are cumulative. As you can see, there is a massive variation between lower and upper results for individual managers, but when you combine multiple managers, simultaneously, the outcomes are a perfect correlation to the industry median (and as time goes by, multi-manager is edging ahead of the national average).

With a single-manager KiwiSaver strategy, you can get any result between the lower and upper limits. You cannot predict or manage these outcomes (no matter what the brochures say). That's great if you get above-average results, but any manager can also fall below-average. As you can see, Multi-Manager investing virtually eliminates this risk, giving you a more reliable outcome.

To have achieved the top returns you would have needed future vision. The top spots have been held by Milford, Quay Street, Generate, Juno, ANZ, ASB and Pathfinder at different times. There is no way in advance to predict who will be the next "star”. With multi-manager, there’s no need to, the average performance is more than is necessary to accumulate significant resources in KiwiSaver and non-KiwiSaver accounts.

Over the time you will be saving for retirement, being the wrong side of average could cost you tens, if not hundreds of thousands of dollars. Don't leave your future to chance. Upgrade today to a Multi-Manager strategy!

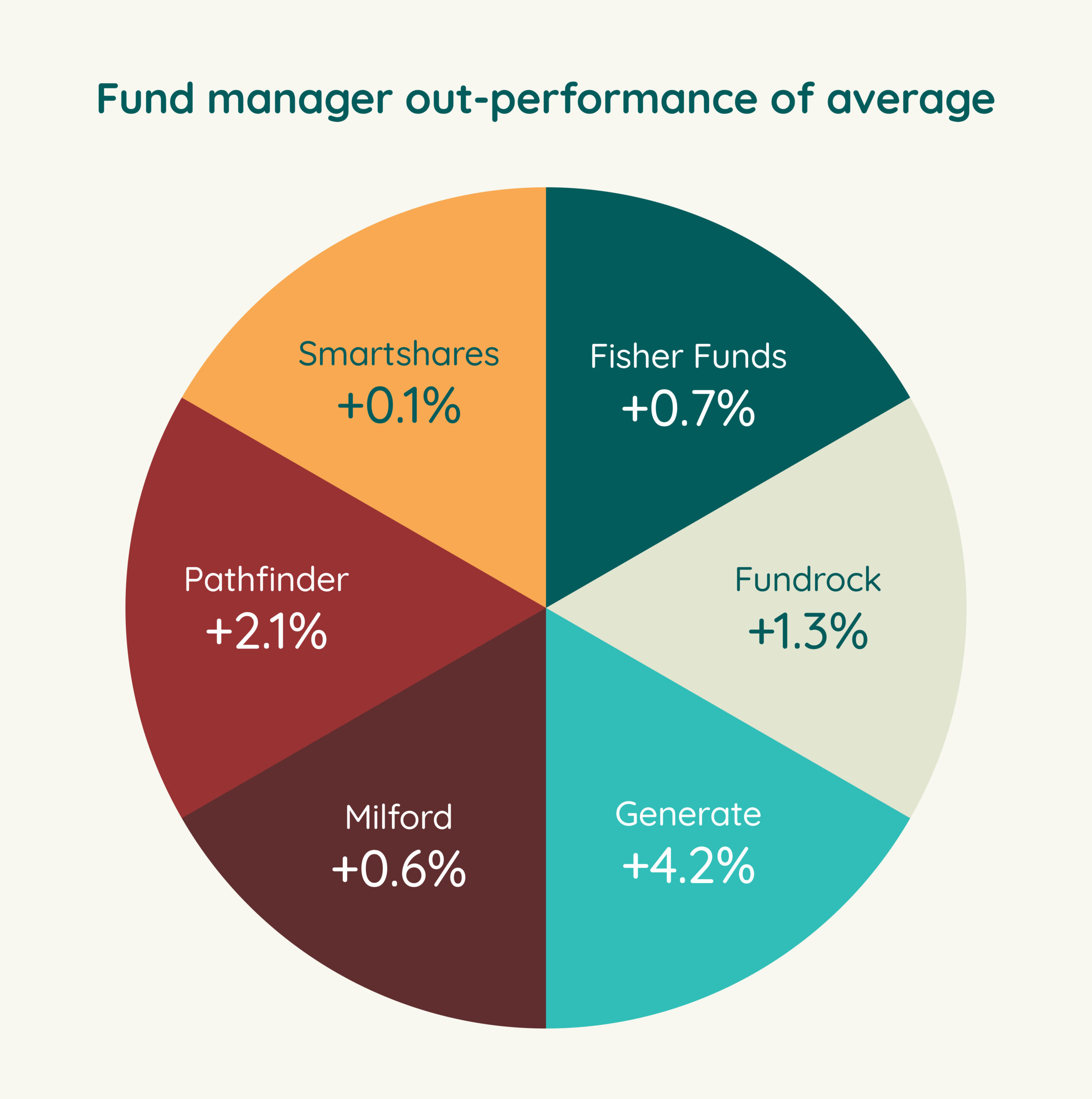

Multi-Manager investing was just a theory 9 years ago but look at the results for the last 12 months! Every growth fund used has outperformed the national average!

Morningstar KiwiSaver Survey to June 30th

- The average result for the last year (to 30/06/24) for KiwiSaver Growth funds was 11.1%.

- The combined result from the 6 Growth funds we use was 12.9%!

- This result puts your collective account managers in the top quartile for NZ

- The rolling returns for these growth managers for the last five years are also ahead of the national average.

Multi-Manager = great performance with lower risk